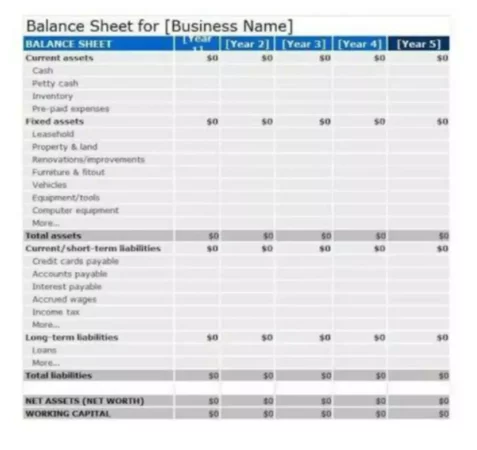

Balance sheet – What is it?

Everything in business, as in life, must be balanced. However, in business, this means something else. Even if you are not an accountant, you probably have heard about a Balance sheet as a thing that is of great importance and that everyone talks about.

The Balance sheet is a table version of the reflection of the organization’s financial indicators as of a certain date. In the most widespread form, the Balance sheet consists of two parts equal in an amount: one shows what the organization has in monetary terms and the other – from what sources it was acquired. This equality is based on the reflection of assets and obligations using the accounting method of double-entry.

The Balance sheet, compiled for a specific date, allows you to assess the current financial condition of the business, and the comparison of the Balance sheet data compiled for different dates – to trace the change in its financial condition over time. The Balance sheet is one of the important documents that serve as a source of data for the economic analysis of the business.

Structure

As you can see from the template presented below, Assets are listed first. The Asset section includes everything that can be converted into a monetary equivalent. This can be premises, equipment, and vehicles owned by the company. The Assets also include the amounts owed by other companies or clients to the business. In simple words, this is everything that belongs to a given enterprise. Assets have three main characteristics:

- store in themselves future economic benefits – the potential directly or indirectly invested in the inflow of cash or cash equivalents;

- give an enterprise ability to control these future economic benefits;

- are the result of past transactions or other events.

The Assets have their own structure and are usually divided into two large classes: current and non-current assets.

- Fixed assets (non-current assets) are any assets that a company uses on an ongoing, long-term basis (for example, equipment and vehicles), as opposed to assets acquired for sale to customers. The useful life of such assets in business is usually more than one year or an operating cycle. Another feature of such assets is that they partially transfer their value in the form of depreciation to the cost of goods, works, services.

- Current assets are assets that you hope to sell or convert into money within one year (for example, goods or amounts that buyers owe you).

Liabilities – an enterprise’s debt arising from past events and will lead to an outflow of business resources containing economic benefits. Obligations have three main characteristics:

- embody an already existing obligation that entails payment via outflow of assets or the provision of services;

- fulfillment of obligations is mandatory and almost inevitable for the enterprise;

- are the result of past transactions or past events.

They are categorized according to their maturity, namely:

- Current (short-term) liabilities are obligations that you have to pay off in the next year (for example, amounts that you owe suppliers or your employees in the form of wages).

- Long-term liabilities are liabilities that you expect to pay off, but not in the next year (for example, long-term bank loans).

Under the liabilities, you might also have an Equity section, which is all the funds of a business that are in its ownership. In other words, this is what will be left when all obligations are covered. Equity is the owner’s share of the business. Equity capital includes share (contributed) capital and retained earnings.

Sample Template

Above, you can see a simple template of the Balance sheet that you can use when preparing financial statements for your company. The Balance sheet statement is always drawn up on a specific date. As a rule, the period for compiling the Balance sheet is equal to a quarter or a year. At the same time, the balance can be drawn up even after each transaction is carried out in the accounting records, but not all accounting programs and ERP systems support this.

The main goal of compiling the Balance sheet is to achieve equality between Assets and Liabilities. The reporting form has an established structure in the form of a table. It can be adjusted depending on the specifics of the enterprise’s activities. In order to draw up this report, you need to get totals for all accounts and classify them as Assets, Liabilities, or Equity. The balance includes all transactions performed as of the date of the Balance sheet preparation.