Overview

There are numerous reasons an individual would need to know their total annual income. This can be an application for a loan, tax payments, as well as child support. What is meant by total annual income? Let’s look at an explanation of each word separately. Instead of the total, you could say all the annual income while annual can be replaced with yearly. Income here refers to the money the individual or entity has received. Thus, total annual income can be paraphrased as how much an entity earns in a year.

There are two types of income one would see. This would be gross and net income.

- Gross incomeGross income is what the employer declares as your salary or wage when offering you a job. When considering a job, many individuals mistakenly think that this is how much cash will actually be in their pocket, which is not true. It is easy to find your gross income because you can simply look at your paycheck and this would be the amount listed first before anything is subtracted from the money you earn.When you complete a tax return, you will be asked for the gross income number, which will serve as the basis for the calculation of your tax refund or tax payment. Your annual gross earnings is also the number that will be requested when you apply to qualify for a loan or credit card. If you own a business gross revenue is also used in the business tax returns. This amount is calculated as total business sales minus the cost of goods sold.

- Net incomeUsually, the employer subtracts taxes and other deductions required by law or agreed to by the employee from the gross income to arrive at the final amount the employee is going to actually receive. This is known as net pay or income. This amount is considered to be a more valuable number because this is how much you will actually have to pay your rent, buy food, clothing, enjoy movies, and so on.Keep in mind that if the tax deductions on your paycheck did not cover your income tax liability, you might need to pay the remaining taxes owed to the government from your net income. If too much was deducted from your earnings, the IRS will return that money to you in the form of tax refunds.

Different types of income

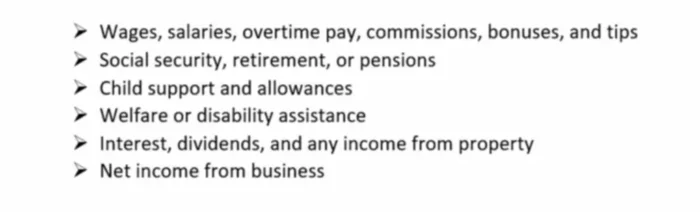

Money received by an individual usually on a regular basis is called income. This income is required to meet one’s basic needs and enjoy other things that one desires, if possible. There are several items you would need to account for when calculating your total annual income. Typical sources of income for individuals are presented below.

Now, let’s look at some of these common sources of income a little closer. Salaries and wages are a fixed amount of money usually received every month or on a bi-weekly basis for doing a particular job. An equivalent of such income would be money received for making and/or selling products, such as handmade jewelry, or providing services, such as tutoring or cleaning. The latter can be an additional income an individual received besides the main salary. It might also become a successful business that brings you a regular income.

If one has already retired, then pensions might serve as the main source of income. These are money you earned during the years of your employment and paid into the pensions fund, which is now paid back to you on regular basis. Individuals can also receive other financial assistance from the government in the form of welfare or disability payments. You might also receive money from your ex-spouse if you have a mutual child in the form of child support.

If you were smart and invested in some stocks, you might also be receiving dividends. These are payments investors receive from companies they invest in and are basically a portion of the company’s profits. Individuals can have other gains and income coming from a rental property they have invested in or a savings account in the form of interest.

Calculating annual income

If your employer pays you on weekly basis, you can easily calculate your total annual wage or salary. This can be either gross or net. Just look at the appropriate numbers on your paycheck. Let’s say Carter makes $1,680 per week working in a retail store. How much does Carter earn per year? As you know, there are 52 weeks in one year. Assuming that Carter’s paycheck has not changed throughout the year, you would simply need to multiply $1,680 by 52 weeks. This would mean Carter has an annual income of $87,360.

Now, let’s assume that this is his gross income. Accordingly, the employer will deduct $6,683 of Social Security and Medicare taxes and $15,725 in Federal income taxes. There is also an insurance deduction that adds up to $1,200 a year. After doing some calculations, we can conclude that Carter’s net pay is $63,752 a year.

To find Carter’s total annual income, you would need to take into account other income sources he might have. Let’s assume Carter has some money in his savings account, which brings him $800 a year. In addition, he gives some diving lessons and earns on average $1,450 a month or $17,400 a year. This would mean his total gross annual income is $105,560.

As you can see, annual income is a concept that everyone will come across sooner or later in their life. Calculating it is also not that complicated. In fact, the other way to estimate it is to add all the money coming to your bank account and any earnings in the form of cash. Keep in mind that salaries deposited to your bank account are your net pay, so this approach is not suitable for calculation of gross annual income.