Premium Bonds

Let’s assume that the business offers a bond with an interest of 10%, while the investment of similar risk in the market is 8%. Rationally, the investor would certainly choose to invest in the bond. However, the business managers are also rational, so they will not sell the bond for $100,000 and pay the 10% interest while they know that the market rate is 8%. Thus, they will sell the bond at a premium.

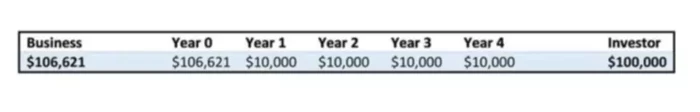

In this case, the business pays an annual interest to the bondholder at the end of each year, which is $100,000 x 10% or $10,000 for each of the 4 years specified in the contract. At the end of the fourth year, the investor will also receive the full bond amount of $100,000. The table below represents the cash flows that will result.

Let’s calculate what this bond is currently worth (Year 0). We need to look at the table for the present value of this annuity (it is an annuity because $10,000 is four equal payments equal time periods apart), where the interest rate will be 8% because even though it is paying out at 10% cash-wise, people are going to earn 8% on this. The n value or number of periods is 4. According to the table, the present value of the annuity is going to be 3.3121. When multiplied by 10,000, we get $33,121 at Year 0.

Next step is to discount $100K back to the present using the present value of the single dollar amount table. It is the same period and interest rate that we used previously. Thus, we are going to take $100,000 and multiply by 7.7350, which gives us $73,500. Thus, the value of our bonds is going to be $33,121 + $73,500 or $106,621. Thus, the business will sell this bond at a premium because people are going to be willing to pay $106,621 for them at Year 0 to be able to get these cash flows in the future.

Amortizing Premium Bonds

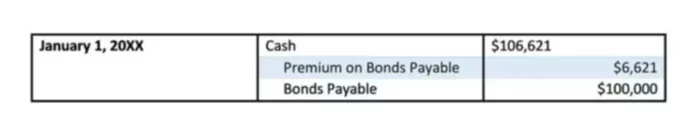

Our financial accounting original entry is going to include Cash coming in for the business ($106,621), the Premium on the bonds payable ($106,621 – $100,000 or $6,621), and Bonds payable ($100,000). This entry will be made when the business sells the bonds. The amounts for Premium on Bonds Payable and Bonds Payable go on the financial accounting report – Balance sheet, reflecting that the business paid this amount for the bonds.

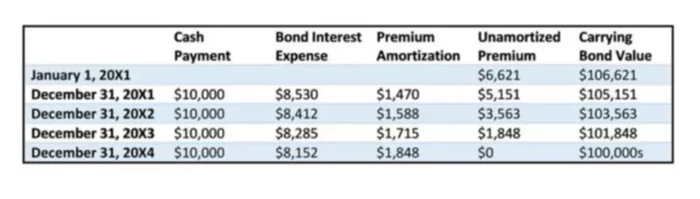

Now, let’s get to the actual amortizing using the effective interest rate. On January 1st, the value of our bond was $106,621 and the premium amount of this that has not been amortized yet is $6,621. On December 31, we are going to have our first interest payment. The cash amount of the payment will be $100,000 x 10% or $10,000. However, the actual interest expense is the market rate, which was used to calculate the value of the bond. Thus, the bond interest expense is calculated by multiplying the carrying bond value by the market interest rate ($106,621 x 8% or $8,530).

The Premium amortization will equal to$10,000 – $8,530 or $1,470. The Unamortized premium is reduced to $5,151 and the Carrying bond value is $100,000 + $5,151 or $105,151. We repeat this amortization calculation for the remaining years. As you can see from the table, in the last year, you will have to slightly adjust the numbers to use up the remaining Unamortized premium amount because the rounding usually adds up to an unaccounted amount.