Amortization is a term that you will come across in the business and accounting world. Its definition can vary based on the context of its use. For instance, the amortization can mean paying off debt or a loan over a period of time using regular payments with a fixed repayment schedule. It is also referred to as spreading the cost of an intangible asset (patents, copyrights, and intellectual property) over its useful life for accounting and tax purposes. Thus, there are two types of amortization you should be familiar with:

- Loan amortization

- Intangibles amortization

Amortization vs. Depreciation

These two terms are sometimes confused. Both terms describe how accountants, in particular, try and deal with the cost of the firm’s long-term assets. This is reported on a company’s balance sheet and income statement. The difference between the two can be described as follows:

- Amortization is used for items that one cannot touch, such as licenses, software, and agreements, and loans. The amortization schedule is used to plan the loan repayment.

- Depreciation is used for items that one can touch, such as machinery, building, and land. A depreciation schedule is all about tax benefits that a business gets by getting tax write-off according to depreciation.

Loan Amortization

Loans are made up of two parts: principal and interest. The principal part is what actually goes toward paying the actual asset that you get to keep, such as your home. The interesting part is what the bank charges you to actually use the money to purchase it and is usually represented as a percent sign.

Since you are making monthly payments towards the loan, the loans itself is going to have a time span, which is typically 15 to 30 years. This spreading of loan repayment into relatively small payments makes it more possible for businesses and people to buy expensive assets and, in the end, own something. Banks make a profit in the form of interest for loaning you that money.

This repayment will adhere to an amortization schedule. For example, if you buy a house with a 30-year mortgage, you will not be paying a portion of interest and a portion of principle that is the same every month for these 30 years. Instead, it is mostly interest upfront with a little bit of going to principle. After many years of paying the mortgage, less of your payment will go to interest and more to the principal.

Intangibles Amortization

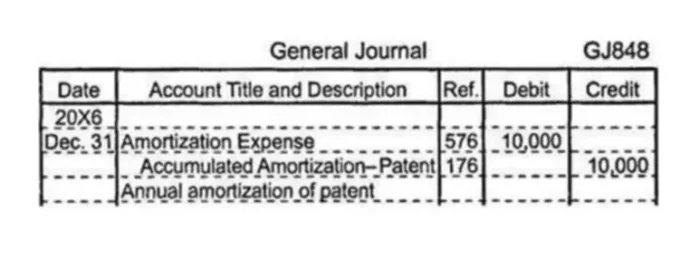

Intangibles amortization is more related to long-term asset depreciation, only in this case, we depreciate, or rather amortize, long-term assets that cannot be physically touched. Generally, it is a legal right to use something exclusively. They can have a finite life, which includes things like copyright, technology, patents, and licenses, or infinite life, and that includes goodwill, trademarks, franchises (while they technically have a finite life, they are renewable as long as the company still exists).

Intangible assets are recorded at cost to get the intangible ready for its intended use. If it has a finite useful life, it is amortized using a straight-line method, generally with no salvage value. Otherwise, it stays on the books at cost, perhaps forever, but we do check it periodically for impairment. If impaired, we debit a loss on an impairment account and credit the (accumulated amortization on) the asset.