Definition and Meaning

Whether you are a business owner or simply an individual who wants to borrow money to finance a purchase or any other need, interest is something you will come across and should be familiar with. It is also an important term if you want to deposit your money into a savings account. When people talk about accrued interest, they usually mean interest accrued annually, although it can be done on any regular basis.

Before we dive into the explanation, let’s define the term accrued. In regards to interest, it means that a bank, for example, calculates how much interest it owes you or how much interest you owe to it. In other words, accrued interest is the adding together of interest or different investments over a period of time. Accrued interest is immaterial to a company’s operational productivity for that period.

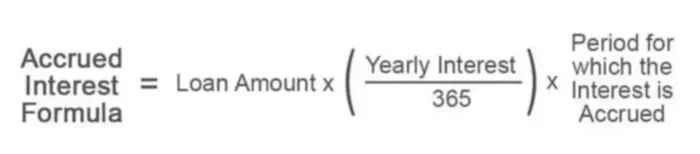

As we mentioned, interest can be accrued not only annually, but also more frequently, for example on monthly basis. The first number you would need to know is the APR, which represents the annual rate of interest in financial activities. It essentially determines how much you will get every year when keeping your funds in the savings account. If you are accruing monthly, you have to divide the APR by 12 months.

Bookkeeping

In accounting, both parties should report the accrued interest, which is usually done at the end of the reporting period. Those who borrow the money would make a record of the interest as an expense, which would also be seen on the Income Statement. On the Balance Sheet, it would be shown as a current liability.

For the financial institution that lent the funds, this interest would be a source of revenue and considered a current asset. To offset these entries, the bookkeeper will use either a payable account (for borrowers) or a receivables account (for lenders).

Example

Let’s say you borrowed $100K from a financial institution to finance your business. The interest rate for that loan is 12%. If the accrual happens at the end of the year, in order to determine what your new debt is going to be, you would multiply the credit amount by the 12% interest rate, which gives you $12,000 in interest payments. Thus, at the end of the year, after the interest has accrued, the new debt that you owe to the bank is going to be $112,000.

Now, let’s assume that the 12% is the APR. This means that you will have a 1% interest rate per month. So, in January, you will multiply your debt by 1%, which gives you $1,000 or $101K debt in total. In February, you will take the new debt amount and multiply it by 1% again. Now, you owe $1,010 in interest and $102,010 in total. You would do this every single month until you hit December.

If you do your calculations, you will have to pay a total of $112,682.50 if accrued monthly in comparison to $112,000 if accrued annually. As you can see, there are different ways to calculate accrued interest and that difference can slowly add up, especially if you are accruing interest more frequently or take a larger loan. Thus, it is important for both sides to closely consider not only the interest rate itself but also how often it is accrued.