When it comes to accounting, timing is everything. To allocate revenues and expenses to the right accounting period, accountants use accruals and deferrals. This approach also helps with comparing financial statements from different periods. Accruals and deferrals follow the Matching Principle and the Revenue Recognition Principle.

The definition of accrue means to accumulate or grow larger in amount, which translates to reporting the revenue and expenses before they are recorded or paid. Defer means to put off doing something until later and in our case, defer recognizing (recording) revenue or expense.

Revenue Accruals and Deferrals

There are two types of revenues that businesses can encounter—deferred and accrued revenue.

- Deferred revenue is an account used to record the money the company receives before actually delivering the product. For example, a software company sells and receives payment for a computer program before delivering and installing it. Businesses do not take into account these revenues as a direct income or included in the income statement, because if something goes wrong, then perhaps the company will need to return this money. Thus, deferred revenue is a Liabilities account.

- Accrued revenue, on the other hand, is an income that a company earned but not yet received. Accrued revenue can arise either after a certain time (for example, interest or rent) or in connection with the provision of services or goods for which the company has not yet received the money. Accrued revenue is considered an Asset on the balance sheet.

Expense Accruals and Deferrals

- Accrual of expenses involves accounting expenses that businesses recognize before they pay or record them. Usually, these are Current Liabilities. Also, these expenses are usually recurring and documented in the company’s balance sheet due to the high probability that the business will incur them.

Business encounters recurring expenses, such as salaries, interest on loans, and taxes regularly. Even though the company will need to pay them some time in the future, it usually reflects them on the balance sheet from the moment when the company can with high certainty expect their occurrence and until they pay them.

- Deferral of expenses is the opposite of accrual of expenses. These are incurred expenses, the result of which businesses will obtain in the future, or expenses that businesses should allocate to future periods. Deferred expenses include “long-term prepayment,” for example, insurance paid in advance for several years, deferred taxes, etc.

The most common type of deferred expense of a commercial organization is capital investments – deferred expenses associated with the use of the organization’s resources to create or acquire non-current assets: fixed assets, intangible assets, long-term financial investments. As you can see, deferred expenses are an asset on the balance sheet.

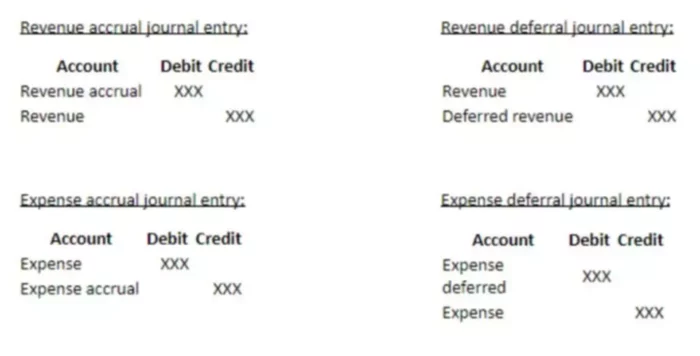

Accruals and Deferrals Journal Entries

Adjusting journal entry ensures that one does not overstate or understate both the income statement and the balance sheet. We should note that adjusting entry, whether for deferral or accrual, does not affect cash. As you can see from adjusting journal entries below, they affect at least one Balance Sheet account and at least one Income Statement account.

Deferred or Prepaid Expenses

Deferred and prepaid expenses might seem like two different terms. Is there a difference? Technically, you can use these two terms interchangeably. However, a deferred expense usually refers to expenses paid over one year in advance and is as associated with long-term assets. Prepaid expenses are, generally, considered to be current assets when the business makes a payment less than one year in advance.