An accounting cycle is a system of actions for identifying, summarizing, and submitting reports on economic events and operations. The stages of the accounting cycle include maintaining transaction records in the ledger, drawing up a trial balance, reconciling accounts, drawing up a financial report, closing accounts, and drawing up a trial balance after closing accounts.

How the Accounting Cycle Works

The specific rules and steps in the accounting cycle allow businesses to reflect their activities accurately, with a minimal likelihood of errors. The accountant should carry out the accounting cycle correctly to help the company understand its position in comparison with its competitors. The correct completion of the accounting cycle is of great importance for enterprises because it helps their managers to know tax obligations. Most companies now use software that allows them to complete the accounting cycle correctly and smoothly.

Steps of the Accounting Cycle

The accounting cycle usually includes eight steps, starting with the identification of the transaction and ending with the preparation of financial reports based on the data received and making closing entries. Let’s go over the main stages of the accounting cycle:

1. Identify transactions

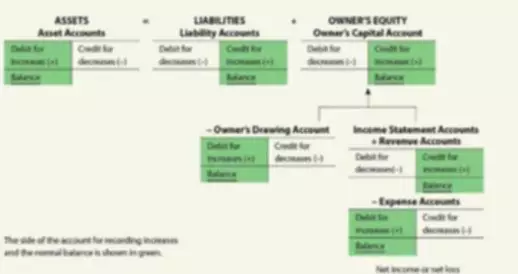

Transaction identification is the very first and most crucial stage. The accountant’s responsibilities include identification and thorough analysis of the transaction before he/she makes a record in the journal. The accountant needs to analyze what types of accounts the transaction involves.

2. Record transactions in the journal

The accountant records all the transactions sequentially in at least two corresponding accounts in the journal. The amounts entered as debits must be equal to the amounts entered as credits.

3. Record journal entries in the general ledger

You might also know it as a book of secondary entries or GL. The accountant transfers every journal entry to the general ledger. Here, it is necessary to monitor that every entry is transferred correctly. One should also indicate the registration number in the journal.

4. Prepare the trial balance and make adjustments

The next step is to prepare a trial balance, which is a total of all debits and credits. The debit amount must be equal to the credit amount. The accountant would also check for accounting errors and, if necessary, make adjusting entry/s. He/she will also make adjusting entries for accruals and deferrals.

5. Prepare financial statements

The company can use the adjusted trial balance to prepare financial reports, such as profit-and-loss statements. It can also prepare the cash flow statement based on data from the trial balance.

6. Make closing entries

When the accounting cycle is over, the accountant would need to close revenue and expense accounts, transferring net income into retained earnings. All temporary accounts are also reset to zero. Next, a trial balance is prepared once more to ensure that debits and credits still balance.

Timing of the Accounting Cycle

The accounting cycle is repeated every accounting period for as long as the business is operating. Usually, this cycle starts on January 1st and ends on December 31st, but the company can do it for any period. The accounting cycle begins when a business has first transactions and ends with the closing of the income statement accounts to be ready for the next accounting cycle.

Accounting Cycle vs. Budget Cycle

As you have learned, the accounting cycle is all about the past transactions and financial history of a particular company. The budget cycle, on the other hand, takes care of future transactions. It reflects how management is planning and analyzing the future budget. Businesses use the budget cycle, mainly for internal purposes. Just like the accounting cycle, the budget cycle can last for a month, quarter, or a year.