Definition

Absorption costing is a costing method that does not just account for the direct costs in the calculation of the cost of goods. In other words, the cost of each unit of a product with this method includes the following costs:

- Direct materials. Resources that are processed to be the final product itself and can be traced back to the final goods without much effort.

- Direct labor. Salaries, wages, and other labor expenses that can be easily tracked for an individual unit made.

- Both variable and fixed overheads.

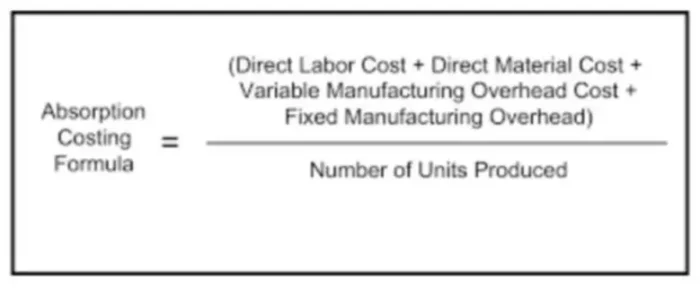

It is also termed as the full or traditional costing method. Accordingly, the calculation of the cost is done using the following formula:

Advantages

The advantage of this particular costing method is that it recognizes that fixed costs are just as important when computing the cost of goods. When using the absorption costing method, the company will less fluctuation in net profit even when production remains constant, but sales fluctuate.

It also allows you to influence the financial result. So, by adjusting the volume of output and sales, managers can control the profit because its amount will depend on what proportion of fixed production costs is already covered by the income from sales, and what remained in stock.

What else can the information on the full cost provided by the absorption method be used for? The full manufacturing cost is the basis for determining the amount of work in progress, inventories, cost of goods indicators, and financial results in financial statements.

This indicator allows you to analyze the profitability of individual goods, product groups, departments and serves as a guide in the decision-making on the feasibility of further production of particular goods. The full cost indicator is widely used in pricing, especially when setting regulated prices.

In the past, the full costing method was widely used to make management decisions under conditions of full utilization of production capacities and the absence of price competition. However, at present, the utilization of production capacities is determined, first of all, by the presence of demand for products, which largely depends on their prices.

Disadvantages

Among the disadvantages, we can name the limited possibilities of its application. This costing method assumes that prices are simply a function of costs and does not take into account the demand. The wider the range of items manufactured, the higher the likelihood of distortion of the cost per unit. Moreover, this method includes past costs which may not be relevant to the pricing decision on hand. The cost-volume-profit relationship is also ignored, so the manager has no hard data to base the decision on.

The absorption costing method does not provide information that aids decision-making in a rapidly changing market environment. This method also has other disadvantages. For instance, the need for the distribution of indirect costs among different types of products, the selection criteria for which are rather vague, makes it difficult to implement this costing method.